The journey of acquiring a new home or embarking on a renovation project embodies the essence of excitement and aspiration for many. However, the past 18 months have witnessed an economic landscape riddled with challenges, primarily characterized by persistent inflation, record-setting Consumer Price Index (CPI) rates, and soaring mortgage rates. These factors have collectively nudged potential borrowers to the sidelines, eagerly awaiting a more favorable financial climate. The Federal Reserve's Signals and the Economic Conundrum

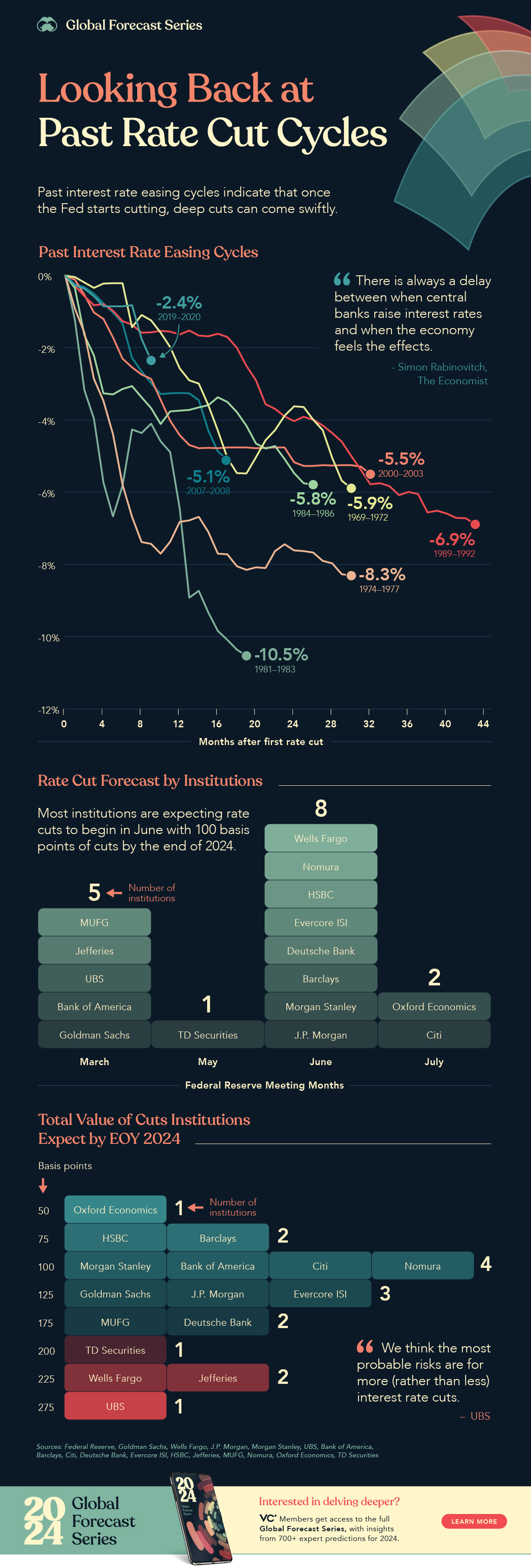

Recently, the Federal Reserve hinted at a possible downward adjustment in interest rates, sparking a glimmer of hope among prospective homebuyers and property developers. This anticipation was met with a complex twist as robust employment figures emerged, presenting the Federal Reserve with a multifaceted dilemma: the timing and magnitude of interest rate cuts. With a March rate reduction now seemingly out of the picture and uncertainties clouding over a May adjustment, the path forward is anything but straightforward.

The Federal Reserve's decision-making process is a delicate balance between curbing inflation without triggering a spike in unemployment rates or dampening consumer spending. This intricate balancing act is further complicated by recent data indicating a significant 9.9% week-over-week surge in new home sales, potentially signaling a rise in consumer confidence.

Implications for Communities and the Housing Market

The eventual easing of interest rates, whenever and however it occurs, will undeniably impact communities nationwide. As consumers regain confidence and step back into the housing market, we may witness a burst of spending activity, with new home constructions and renovation projects picking up pace. This anticipated boom poses a unique challenge to municipalities and local governments as they strive to meet the increased demand for timely and efficient services.

A Proactive Approach to Managing Demand

In response to these evolving dynamics, many municipalities are adopting innovative strategies to enhance their capacity to address changing demands. By partnering with firms that offer supplemental capacity and capabilities, these local governments are positioning themselves to respond more effectively to the needs of their communities. SAFEbuilt stands at the forefront of this movement, offering a compelling solution with its team of over 1,700 professionals and a best-in-class proprietary technology stack.

The SAFEbuilt Advantage

SAFEbuilt's partnership model is designed to empower communities across the United States to navigate the complexities of fluctuating activity levels in real time. With a focus on delivering city management solutions that provide real-time visibility into critical data, SAFEbuilt ensures that essential services are rendered with unparalleled quality and timeliness. This approach not only enhances the efficiency of building departments but also plays a pivotal role in supporting the housing market's recovery and growth.

In conclusion, as the Federal Reserve contemplates its next moves, the ripple effects will be felt across the housing market and beyond. The anticipation of lower interest rates holds the promise of reinvigorating consumer interest in home buying and renovations. Amidst these shifts, the strategic collaboration between municipalities and firms like SAFEbuilt emerges as a key factor in ensuring communities can adapt and thrive in the face of changing demands.

As we navigate these uncertain times, the importance of agility, innovation, and partnership in sustaining the dynamism of the housing market cannot be overstated.

About the Author: Joe DeRosa, President and Chief Revenue Officer at SAFEbuilt, has driven significant growth since joining the company five years ago, leveraging his global consultancy expertise. Author of 'The Customer Mindset,' he combines strategic innovation with customer-centric insights. Residing in Philadelphia, Joe’s leadership reflects a commitment to excellence and community engagement.